Leasing & Equipment Finance Options

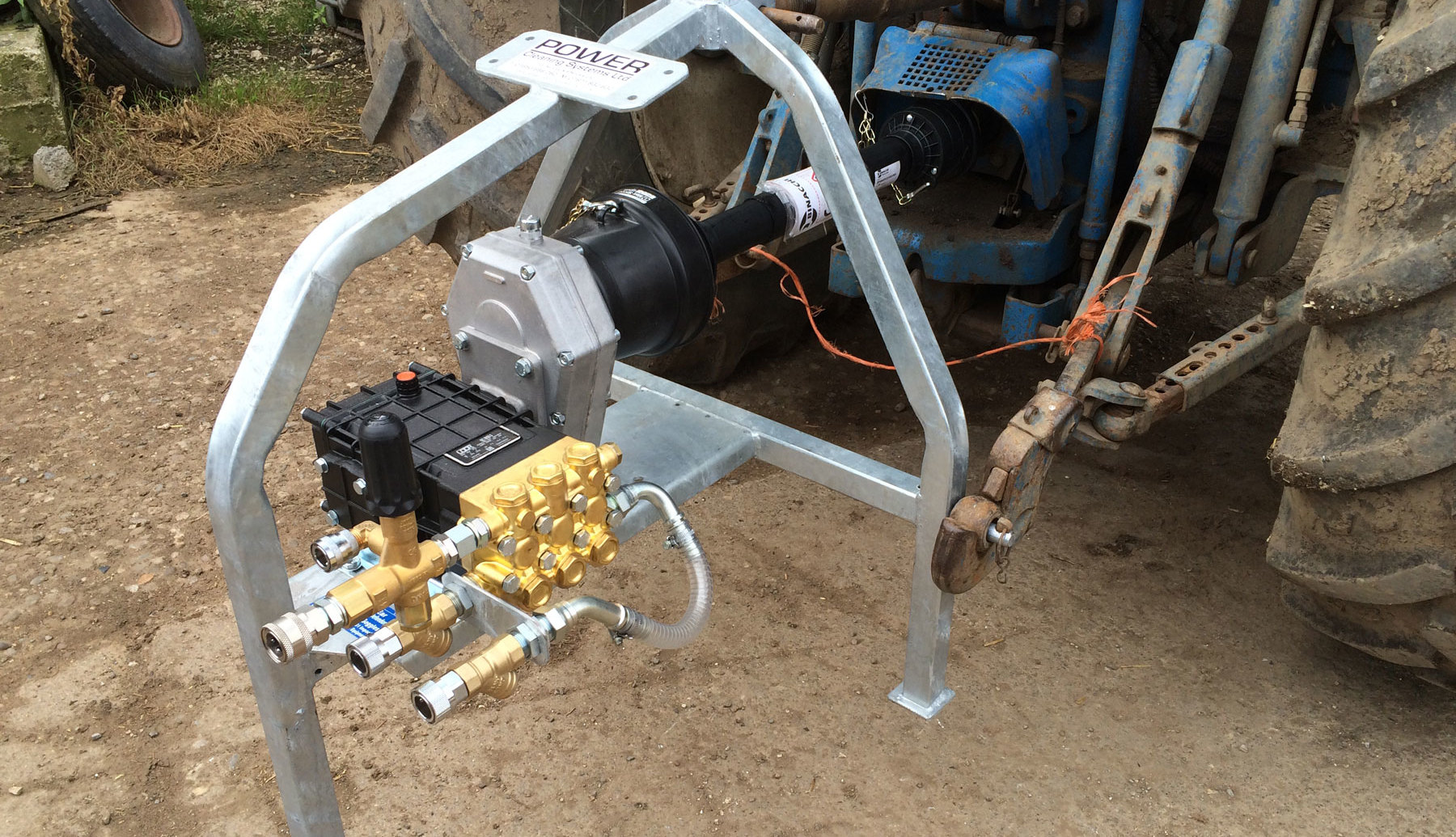

Power Cleaning Systems has partnered with leading business finance brokers Anglo Scottish Asset Finance Ltd to bring you competitive leasing contracts and finance, focused on your needs.

We understand the importance of making correct decisions for your business. Whether you’re a sole trader with a small take-away, or the Managing Director of an international corporation, leasing your equipment has benefits.

Businesses across the UK, including 95% of FTSE 100 companies according to surveys carried out by the Finance & Leasing Association, regularly lease equipment. It’s very easy to understand why when considering the benefits;

100% Tax Deductible

Preserve Your Capital for More Profitable Uses

Simplify Your Budgeting and Forecasting

Chose Equipment that Meets Your Requirements

Maintain your Existing Credit Lines

Improve your Return on Investment

Easily Upgrade to New Equipment

In summary, the benefits of leasing speak for themselves call today to find out more about leasing or finance options on any of our equipment, or for more information on how leasing can benefit your business, simply contact Karl Warwick at Anglo Scottish Asset Finance Ltd directly using the contact details provided below.

F.A.Q.’s

How much can be financed? – Anything from £1000 + VAT upwards

How long can equipment be leased for? – The most common terms are 3 or 5 years, however 1,2 and 4 are also available.

What about the VAT? – The VAT is funded throughout the agreement, so you pay and reclaim the VAT on the monthly payments.

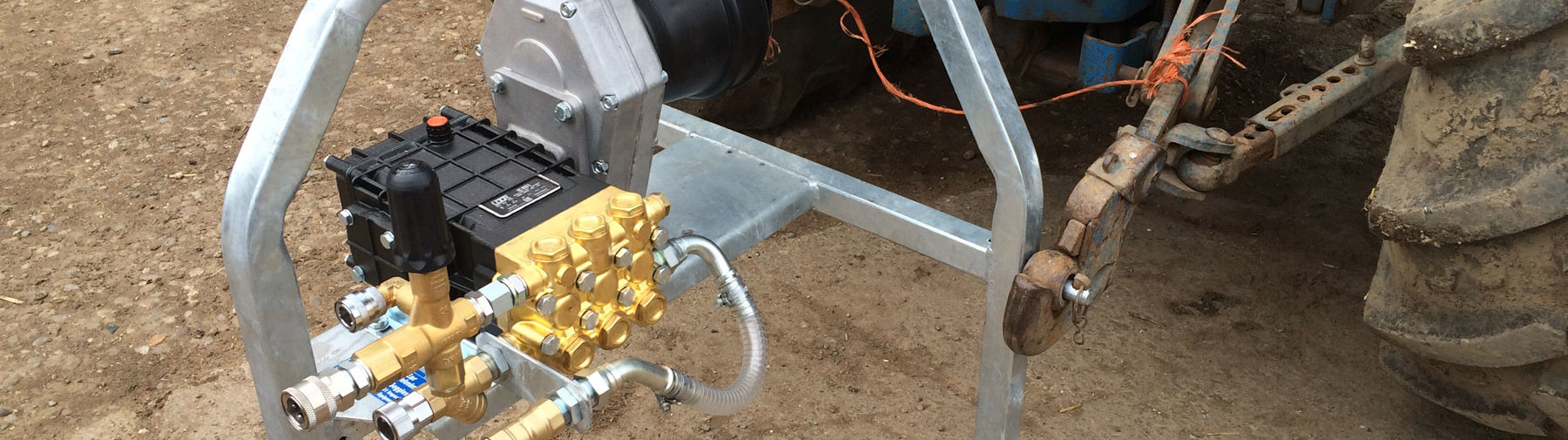

What can be leased? – Any of our equipment can be considered, both new and reconditioned.

How are payments made? – All monthly or quarterly payments are taken via Direct Debit.

Is an upfront payment required? – The first payment on most Agreements is taken approximately ten days after the equipment is delivered.

Isn’t leasing for companies who can’t afford to pay cash? – No, its the smart choice, most accountants and over 80% of Britain’s blue chip businesses view leasing as the most cost effective way to acquire capital equipment.

What happens if the goods become obsolete? – Equipment can be upgraded at any time. You would simply sign a new Agreement to incorporate the discounted outstanding balance on existing finance which would then be cancelled.

Contact PCS to see how affordable leasing your equipment can be. And remember, in real terms you could be saving 25% on the payments, as they’re deductible against your pre-tax profits!

Contact PCS for further information on finance and leasing options or

Karl Warwick at Anglo Scottish Asset Finance Ltd directly on the details below.

DDI: (0191) 3389918 / M: 07814 759 405 / Email: karl.warwick@angloscottishfinance.co.uk